Retirement, pensions and superannuation are topics all Australians need to think about – and the sooner the better. For tax practitioners, understanding the ins-and-outs of a client’s rights in...

Retirement, pensions and superannuation are topics all Australians need to think about – and the sooner the better. For tax practitioners, understanding the ins-and-outs of a client’s rights in...

Superannuation is a regular part of most Australian's lives –but many don't really understand the ins and outs of the rules around concessions, pensions and how our super is taxed. That's where tax...

Superannuation affects almost everybody in Australia. As a tax practitioner, being able to confidently advise your clients on this crucial topic gives them greater control and confidence to make the...

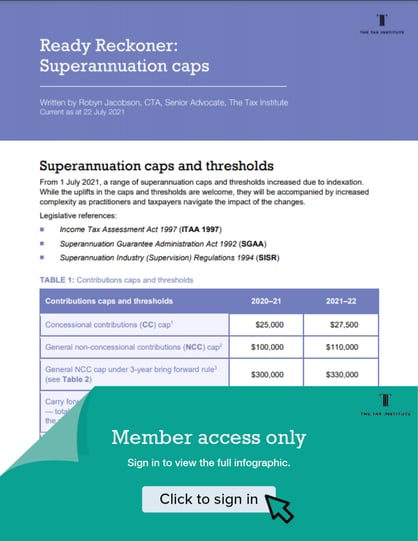

From 1 July 2021, a range of superannuation caps and thresholds increased due to indexation. While the uplifts in the caps and thresholds are welcome, they will be accompanied by increased...

Single Touch Payroll (STP) is a reporting regime that is designed to reduce employers’ reporting burdens to government agencies. In the past, an employer reported certain payroll information to the...

As a tax professional, keeping your skills and knowledge up to date through continued professional development is vital. It’s how you ensure you’re giving your clients the best, most current advice.

In this week’s TaxVine newsletter preamble, I outlined the main points arising in The Tax Institute’s Federal Budget 2021–22 submission, which our Tax and Policy Advocacy team has put considerable...

As any tax practitioner knows, keeping up with compliance obligations is key to running a successful practice, looking after client’s best interests and staying on the right side of regulators. But...

We recently kicked off The Tax Summit: Project Reform, with the first Focus Session in our all-star lineup, featuring speakers Phil Broderick, CTA, Sladen Legal and Ian Raspin, CTA, BNR Partners, in...

Now in its eighth year, the National Superannuation Conference is recognised as the leading event for tax practitioners specialising in superannuation. Sessions deal with issues facing both the...

© 1996-2016 The Tax Institute (ABN 45 008 392 372) All rights reserved.