An abridged version of this case summary was published in edition 19 of our TaxVine newsletter, and published here in full. It unpacks the Commissioner of Taxation’s special leave application to...

An abridged version of this case summary was published in edition 19 of our TaxVine newsletter, and published here in full. It unpacks the Commissioner of Taxation’s special leave application to...

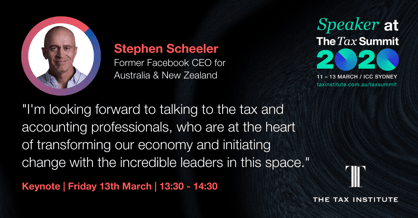

Rapid shifts in technology are transforming the way we conduct business and are set to impact the heart of the Australian economy, says former Facebook CEO, Stephen Scheeler.

Ahead of his keynote...

By Senior Tax Counsel Bob Deutsch, CTA

With effect from 1 July 2019, Australia has had a new comprehensive whistleblower protection regime which covers the corporate, financial and tax sectors. The...

By Senior Tax Counsel Bob Deutsch, CTA

Concessions in respect of research and development (R&D) in the form of either offsets or deductions have been an integral part of the Australian tax framework...

By Bob Deutsch, CTA, Senior Tax Counsel

(All monetary references are to USD)

I have just returned from holidaying in North America – what a spectacular sight to witness the fall colours in Vermont...

My involvement with the Tax Institute’s Victorian State Taxes Committee began...

In this environment of tight banking controls, one of the most vulnerable pieces of information relating to a client’s bank account are the bank account details a tax agent enters on the ATO...

By Bruce Quigley, CTA, Senior Adviser

Earlier this week, the Tax Institute made a pre-budget submission (the submission) to the Treasurer the Hon Josh Frydenberg MP.

The submission observed that to...

By Angie Ananda, FTI

Under proposed changes, the ATO will be able to report tax debts of at least $100,000 that have been outstanding for more than 90 days to credit reporting bureaus.

This is a...

By John Ioannou, CTA

In Queensland, there is a big interest at present on the impact of foreign acquirer land tax and duty surcharges. This issue is also one that is topical across most State and...

© 1996-2016 The Tax Institute (ABN 45 008 392 372) All rights reserved.