Despite natural disasters, variability in commodity prices and markets and general economic challenges, Australia’s primary producers are keeping the country running. The financial, tax and legal...

Despite natural disasters, variability in commodity prices and markets and general economic challenges, Australia’s primary producers are keeping the country running. The financial, tax and legal...

If you’re a tax practitioner working in the trusts space, you’re probably looking forward to our upcoming 2021 Private Business Tax Retreat, where multiple sessions will be devoted to untangling the...

As businesses around Australia start their recovery from the financial impact of COVID-19, the tax practitioners who work with them need to be on top of their game. Whether it’s assisting with...

The Tax Summit: Project Reform is underway! Last week, our speakers, John Ioannou, CTA, Deloitte Private, Mark Molesworth, CTA, BDO and Andrew Noolan, CTA, Brown Wright Stein Lawyers joined Robyn...

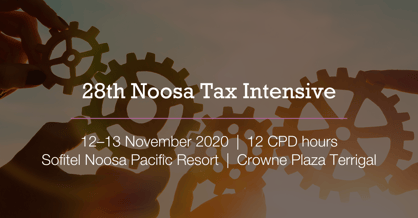

The Noosa Tax Intensive has returned in 2020, reinvented for a digital and safely socially-distant world. Australia’s premier SME event, the 28th Noosa Tax Intensive is split across two...

Longer life expectancies are making estate planning for family businesses a more complex issue than it previously has been.

Whilst the concept of estate and succession planning for a family...

© 1996-2016 The Tax Institute (ABN 45 008 392 372) All rights reserved.