The tax profession is continuing to move in an exciting new direction, as the next generation of talent continues raising the bar on academic achievement, strengthening client relationships and contributing to the community.

We spoke to the finalists of The Tax Adviser of Year Awards 2020, to discover what being shortlisted means to them personally, as well as to their career.

An exciting evolution in the profession

Adrian Varrasso, ATI from MinterEllison, who is a finalist for the Corporate Tax Adviser of the Year category, says it’s a challenging and exciting profession, which is made both easier and more rewarding by being a member of The Tax Institute.

“It is an honour to be shortlisted as a finalist for the Tax Adviser of the Year awards for a second year, alongside such a talented group," he says. "When one looks at the quality of tax advisors in this country and across the Tax Institute's membership base, it makes you realise how special it is to even be considered for one of these awards, let alone to be selected as a finalist!"

Julianne Jaques, CTA from Victorian Bar and finalist for our Chartered Tax Adviser of the Year award, adds, “these awards are given by The Tax Institute, the premier association for tax advisers, with a membership base that includes the best tax advisers in Australia. Given the calibre of the finalists – I'm honoured to be considered."

Working towards common goals in a close-knit community

Emerging Tax Star finalist Louise Van Wyk, FTI from Greenwoods & Herbert Smith Freehills, recognises that the high calibre of talent in this year’s shortlist, all provide top quality advice and significant contributions to the broader tax economy.

“This recognition is also a testament to my mentors who have guided and encouraged my career in the tax industry – I certainly feel like I am on the right pathway,” she says.

Melissa Bader, ATI from KPMG Law and an Emerging Tax Star finalist states, "being a finalist is a great personal achievement reflecting the hard work and the challenges I have encountered during my career. This award provides recognition by the broader tax community of my contribution to our profession."

Chris Wookey, CTA from Chris Wookey Chartered Accountants, believes being a finalist for the SME Tax Adviser of the Year award is an achievement of his career goal to be recognised by the broader tax community.

"Being recognised and respected in the tax community has long been a personal goal of mine, so having been anonymously nominated, let alone making it as a finalist for the Tax Adviser of the Year Award, feels like a fulfilment of that goal," he adds. "I’m honoured to be a finalist because it is awarded by The Tax Institute – the pre-eminent body representing the tax consulting profession in Australia."

“It's an honour to be a finalist because it represents recognition of my development as a tax practitioner and will serve as a springboard for increased involvement with the Tax Institute," Emerging Tax Star finalist, Peter Scott, FTI from Arnold Bloch Leibler adds.

Strengthening client relationships

According to Matthew Cridland, CTA from K&L Gates, being a finalist for the Chartered Tax Adviser of the Year award demonstrates just how important teamwork and collaboration is when supporting clients in a fast-paced advisory environment.

"As a finalist, the recognition is a testament to the dedication and collaboration of all my colleagues in K&L Gates' tax team,” he says. “It’s a reflection of the rewarding work we do on sophisticated matters to support our clients."

Another Chartered Tax Advisor of the Year finalist, Peter Feros, CTA from Clayton Utz agrees. He sees the award as a true recognition from peers, and one of the greatest accolades a professional can receive.

"There are many wonderful and smart people who make up our profession,” he says. “To be selected from among that group is very humbling.”

Surfacing the critical role of the corporate tax adviser

According to Cameron Blackwood, ATI from Greenwoods and Herbert Smith Freehills, being nominated for the Corporate Tax Adviser category signifies the increasingly critical role of the corporate tax adviser in today’s highly volatile business landscape.

"It's an honour to be a finalist, because the role of a corporate tax adviser is increasingly important within a client’s business,” he says. “So much of my success comes from having great relationships with clients and being part of their business transformations through transactions. It’s so important to me, as a corporate tax practitioner, to continue contributing to and helping shape the tax community through organisations like The Tax Institute."

For Norah Seddon, ATI from PwC, being a finalist in the Corporate Tax Adviser category is a great time to acknowledge colleagues and clients that form part of her corporate tax practice, and reflect on what it takes every day to build great working relationships.

"Thank you to my colleagues and clients who nominated me for the award and the people who I work with every day - I wouldn't be where I am without you,” she says. “And congratulations to all of the finalists. It's a privilege to be part of such a great group of tax professionals."

Daryl Choo, ATI from EY, agrees. She considers, “being a finalist in this category is a special way of paying tribute to the people who believed in and invested in her throughout her career”. She also adds, “It’s an honour to be a finalist because there are so many well respected, incredibly talented and inspiring tax professionals who have made significant contributions to the industry and it is so humbling to be recognised for my contribution.”

The vision for best practice in the SME market

For finalists of the SME Adviser of the Year category, the recognition helps to highlight their efforts to provide best practice in a highly competitive marketplace.

“It's an honour to be a finalist because it's a huge recognition of my work and career amongst high calibre tax professionals,” Natalie Claughton from MC Tax Advisors, says. “It's also an affirmation that the firm we established, MC Tax Advisors, has the place within the tax profession and the SME market that we envisaged.”

Leanne Connor, CTA from WGC Business Advisors, agrees. Also a finalist in this category, she sees the achievement as a recognition from the SME practitioners community of her continuous efforts to uphold the highest of qualities throughout her career.

“I'm proud to be recognised amongst peers who value my professional contribution. Especially given this is an award which highlights the pinnacle of qualities that I strive to consistently achieve and uphold throughout my career."

A celebration of diversity in leadership

This year saw a 50/50 split in gender split in demographic, signalling a shift towards a more diverse decade of tax leadership ahead.

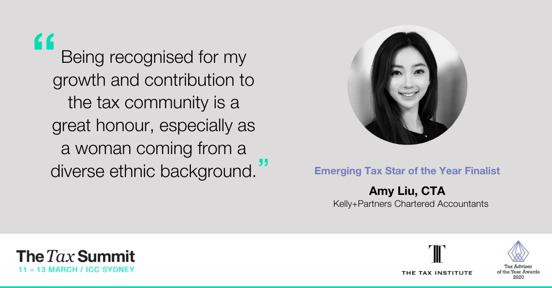

"Being recognised for my development, growth and contribution to the tax community is a great honour, especially as a woman coming from a diverse ethnic background,” Amy Liu, CTA from Kelly+Partners Chartered Accountants and Emerging Tax Star finalist, says. “It's also an exciting opportunity to build my personal brand as I expand my network and continue my journey in tax."

SME Tax Adviser of the Year finalist, Tania Waterhouse from Waterhouse Lawyers, says she hopes these awards will inspire more women to consider a career in tax.

"I hope being a finalist of the Tax Adviser of the Year awards will serve as inspiration to those joining the tax profession who, like me, are female and started their tax journey later in life," she says. "Being a finalist of the Tax Adviser of the Year Awards is the crowning achievement of being a tax professional, a profession that I have always felt privileged to be a part of. It’s like being nominated for the ‘Tax Oscars’ and the ultimate endorsement by my peers.”

Manuel Makas, CTA from Greenwoods & Herbert Smith Freehills, is a finalist of the Chartered Tax Adviser of the Year Category, and agrees it’s a great opportunities for professionals from all diverse backgrounds to be celebrated for their contribution.

“Being a finalist is a recognition of what I bring to the tax profession and in particular, my focus on ensuring that people from diverse backgrounds are given opportunities and rewarded," he adds.

Emerging Tax Star finalist Donovan Castelyn, from Curtin University and the Curtin Tax Clinic, says the awards also represent supporting greater diversity when it comes to various avenues of tax practice.

"I'm honoured to be a finalist because it reflects the Tax Institute’s willingness to support alternative avenues of tax practice and encourages sustained participation in the pro-bono and academic sector," he says.

Celebrating the biggest and brightest minds in tax

Finalists agree The Tax Institute celebrates the brightest minds in tax, and being part of this evolving and collaborative community is exciting for any forward-thinking tax professional.

Matthew Popham, CTA from Newmont Goldcorp Australia and Corporate Tax Adviser of the Year finalist, adds, "The Tax Institute is the pre-eminent tax body in Australia containing the brightest and best tax minds in the country. So, to be recognised in this way is very special."

Christopher Annicchiarico from WRP Legal & Advisory, agrees. “It’s so exciting to be a finalist, given the Emerging Tax Star category recognises the brightest and best young tax minds in the country,” “To be held in the same esteem as these gifted practitioners is a true privilege. Furthermore, the nominees are selected by a judging panel comprising of prominent leaders within the profession; to have their endorsement is immensely fulfilling.”

Don’t miss out on the biggest night of the Tax Social Calendar!

The winners of The Tax Adviser of Year Awards 2020 will be announced at The Tax Summit Gala Dinner at the world-class International Convention Centre (ICC), Sydney on Thursday 12 March.

“The Tax Adviser of the Year Awards is an incredible opportunity for the finalists to showcase their achievements and contribution to the tax community,” CEO of The Tax Institute, Giles Hurst, says. “And what better place than at The Tax Summit Gala Dinner at the ICC, the biggest event of its kind. It’s going to be an exceptional evening.”

Find out more about the Tax Adviser of the Year Awards at: https://info.taxinstitute.com.au/taxawards

Watch the short clip below to hear what the Tax Adviser of the Year Awards in 2019 meant to our winners.

Attendance at The Tax Adviser of the Year Awards and The Tax Summit Gala Dinner is included for all full registrants of The Tax Summit, with additional tickets available for guests or tables of ten.

Want to master the skills of a tax leader?

Discover over 60 sessions delivered by local and global tax experts, across SME, Corporate and Hot Topic streams.

The Tax Summit also includes keynote sessions from the biggest and brightest minds in tax, 90+ speakers, interactive workshops and four new streams: Professional Practice, Emerging Leaders, International and Technology.

With over 1,000 attendees against the stunning harbourside backdrop of the ICC in Sydney, The Tax Summit is the unmissable opportunity to network, refine your skills and take your career to the next level.

Don’t get left behind. Register for The Tax Summit 2020 today.