JobKeeper key dates & payroll cycles

by Robyn Jacobson, CTA, Senior Advocate

Note: the information on this page refers to the 2020 COVID-19 stimulus measures. Please check dates carefully.

Looking for the latest on COVID-19 support measures? Explore our guide to 2021 COVID-19 Support Package.

Since the Coronavirus Economic Response Package (Payments and Benefits) Rules 2020 (the JobKeeper Rules) were registered on 9 April 2020, there has been confusion among many accountants, tax practitioners and business owners as to what they have to do and by when to receive assistance under the Government’s JobKeeper program.

The confusion was exacerbated by:

- the pace at which the new law was implemented and applied following the Government’s announcement of the JobKeeper program on 30 March 2020;

- the subsequent release of further information including the Commissioner’s legislative instrument, the Coronavirus Economic Response Package (Payments and Benefits) Alternative Decline in Turnover Test Rules 2020 which were registered on 23 April 2020;

- the subsequent amendments to the JobKeeper Rules, the Coronavirus Economic Response Package (Payments and Benefits) Amendment Rules (No. 2) 2020, which were registered on 1 May 2020; and

- at times, the ATO guidance which has continued to emerge in real time as entities have been enrolling in JobKeeper and paying at least $1,500 per fortnight in salaries and wages to eligible employees in order to meet the wage condition.

The following terms are used in this article — based on the terminology used by the ATO’s Online Services — to explain the key JobKeeper dates you need to know:

Step 1 | Enrol business for JobKeeper wage subsidies Enrol an eligible business that has been significantly affected |

Step 2 | Identify employees eligible for JobKeeper wage subsidies Employers and employees must complete a JobKeeper Employee Nomination Notice If adding a business participant, entities and eligible business participants must complete an eligible business participant nomination notice |

Step 3 | Business monthly declaration for JobKeeper payment Confirm eligible employees, eligible business participant and GST turnover each month |

JobKeeper key dates: what does the law say?

The discussion immediately below explains the key dates as prescribed by the JobKeeper Rules; but these are adjusted by an explanation of the ATO reporting concessions and deferrals which follows below.

Step 1 — Enrolment in the JobKeeper program

Section 6(2) (for employers) and s. 11(2) (for entities eligible based on business participation) of the JobKeeper Rules requires an entity that elects to participate in the JobKeeper program to enrol by:

- for an entitlement in the first or second JobKeeper fortnights (i.e. ending 12 April and 26 April 2020) — the end of the second JobKeeper fortnight (i.e. 26 April 2020);

- for an entitlement arising in any other fortnight — the end of the fortnight.

The Commissioner has the power to defer the date by which an entity must enrol.

Step 2 — Identify eligible employees and eligible business participant

The JobKeeper Rules do not set out a date by which this information must be provided to the ATO. Section 6(1)(f) simply says the employer meets one of the eligibility conditions if they provide information about the entitlement, including details of the eligible employees, to the Commissioner in the approved form.

Section 11(1)(f) states the same for eligible business participants.

Step 3 — Monthly reporting of GST turnover

Section 16(1) of the JobKeeper Rules require entities that are enrolled in the JobKeeper program to notify the Commissioner of monthly GST turnover information. The month in which a JobKeeper fortnight ends is referred to as the reporting month.

Within 7 days of the end of a reporting month, the entity must notify the Commissioner in the approved form of:

- the entity’s current GST turnover (i.e. the actual GST turnover) for the reporting month; and

- entity’s projected GST turnover for the month following the reporting month.

In this context, current GST turnover means the actual GST turnover for the reporting month, so do not report 2019 turnover.

JobKeeper key dates: what does the ATO say?

Recognising that some of these dates may be difficult to comply with in practice, the ATO has exercised discretion to extend the JobKeeper enrolment and reporting dates.

The JobKeeper Rules do not set out a date by which the eligible employees/eligible business participants must be notified to the ATO so the ATO has aligned the due dates for enrolment (Step 1) and notifying eligible employees/eligible business participants (Step 2). The ATO has also combined the monthly reporting of GST turnover (Step 3) and reconfirming eligible employees and eligible business participants into the same online form.

The ATO must pay the JobKeeper payments for a reporting month no later than the later of:

- 14 days after the end of the month in which the relevant JobKeeper fortnight ends; and

- 14 days after the entity has made the necessary notifications (i.e. the monthly reporting of GST turnover).

So the ATO will allow an entity until 14 days after the end of the month to report its GST turnover (instead of within 7 days as per the JobKeeper Rules), but taking advantage of this extended time to report will delay the entity’s JobKeeper payments. For example, if an entity did not report its GST turnover for May 2020 until 14 June 2020, the entity may have to wait until 28 June 2020 to receive its JobKeeper payments for May. Generally, however, the ATO will pay JobKeeper payments within a week of the requisite notifications being made.

The table below sets out for each of the 13 JobKeeper fortnights:

- the date by when the wage condition must be met;

- the date by which an entity must enrol in the JobKeeper program (i.e. Step 1);

- the reporting month;

- the date by which entities must notify eligible employees/eligible business participants and report monthly GST turnover (i.e. Steps 2 and 3);

- the month in which the ATO pays the JobKeeper payments; and

- the Monthly JobKeeper payment per eligible employee.

JobKeeper fortnight | Date by which wage condition must be met (at least $1,500 per fortnight) | STEPS 1 AND 2 Last day for enrolment and notifying eligible employees and eligible business participants: per ATO (and per JobKeeper Rules) | Reporting month | STEP 3 Last day for reporting monthly turnover and reconfirm eligible employees and eligible business participants: per ATO (and per JobKeeper Rules) | Month of payment | Monthly JobKeeper payment per eligible employee |

① 30 March–12 April 2020 ② 13–26 April 2020 | 8 May 2020 (instead of 12 April and 26 April 2020) | 31 May 2020 (instead of 26 April 2020) | April 2020 | Report by 31 May 2020 (instead of 7 May):

| June 2020 (instead | $3,000 |

③ 27 April–10 May 2020 ④ 11–24 May 2020 | 10 May 2020 24 May 2020 | 31 May 2020 (instead of 10 May and 24 May 2020) | May 2020 | Report by 14 June 2020 (instead of 7 June 2020):

| June 2020 | $3,000 |

⑤ 25 May–7 June 2020 ⑥ 8–21 June 2020 | 7 June 2020 21 June 2020 | 30 June 2020 (instead of 7 June and 21 June 2020) | June 2020 | Report by 14 July 2020 (instead of 7 July 2020):

| July 2020 | $3,000 |

⑦ 22 June–5 July 2020 ⑧ 6–19 July 2020 | 5 July 2020 19 July 2020 | 31 July 2020 (instead of 5 July and 19 July 2020) | July 2020 | Report by 14 August 2020 (instead of 7 August 2020):

| August 2020 | $3,000 |

⑨ 20 July–2 August 2020 ⑩ 3–16 August 2020 ⑪ 17–30 August 2020 | 2 August 2020 16 August 2020 30 August 2020 | 31 August 2020 (instead of 2 August, 16 August and 30 August 2020) | August 2020 | Report by 14 September 2020 (instead of 7 September 2020):

| September 2020 | $4,500 |

⑫ 31 August–13 September 2020 ⑬ 14–27 September 2020 | 13 September 2020 27 September 2020 | 30 September 2020 (instead of 13 September and 27 September 2020) | September 2020 | Report by 14 October 2020 (instead of 7 October 2020):

| October 2020 | $3,000 |

Payroll cycles

There has also been confusion regarding payroll cycles. The JobKeeper Rules do not require any employer to change their payroll cycle or require them to ensure their payroll cycles conform to the JobKeeper fortnights.

The table below sets out examples of weekly, fortnightly and monthly payroll cycles and how much needs to be paid each pay cycle to meet the wage condition.

Payroll cycle | Minimum amount to meet wage condition |

Weekly Employer pays their eligible employee every Thursday | Employer must pay at least $750 per week |

Fortnightly Employer pays their eligible employee every 2nd Tuesday | Employer must pay at least $1,500 per fortnight, even if the fortnights do not align with the JobKeeper fortnights. There is no requirement that the payment to the employee be referable to work done in the JobKeeper fortnight. What is required is that a payment of at least $1,500 is paid to the employee during the JobKeeper fortnight. Example — 1st JobKeeper fortnight JobKeeper fortnight: 30 March to 12 April 2020 Payroll cycle: 1 April to 14 April 2020 Payments dates (in arrears): 31 March, then 14 April etc. The payroll cycle may end on 14 April 2020, which is 2 days after the end of the JobKeeper fortnight, but the preceding payment was made on 31 March, which falls within the JobKeeper fortnight. Example — Fortnightly payroll cycle An employer ordinarily pays an employee $2,000 in one fortnight, and $800 in the next. It is not possible to aggregate the two amounts, or carry an excess amount over from another fortnight, so the required top-up for the second fortnight is $700. |

Monthly Employer pays their eligible employee on the 15th day of the month | Employer must pay at least:

The ATO will accept either of these, however if the employer chooses to pay at least $3,250 per month for the 6 JobKeeper months, the ATO will not pay JobKeeper payments of more than $3,000 per eligible employee per month other than in September (for the three fortnights ending in August) when the payment will be $4,500 per eligible employee. Unlike fortnightly payroll cycles, there is no requirement that payments under a monthly payroll cycle be paid in the fortnight. This is because the ability to allocate a payment to a JobKeeper fortnight in a reasonable manner is available only where the pay period is longer than a fortnight. Example — Monthly payroll cycle An employer ordinarily pays an employee $2,800 for a month. The required top-up is $200. |

JobKeeper 2.0

The Government announced on 21 July 2020 that a modified JobKeeper program will continue for another six months beyond its legislated end date of 27 September 2020 until 28 March 2021. This follows a three-month review of JobKeeper which concluded that the case for extending JobKeeper beyond September is strong.

No changes will be made to the existing JobKeeper arrangements until 28 September 2020.

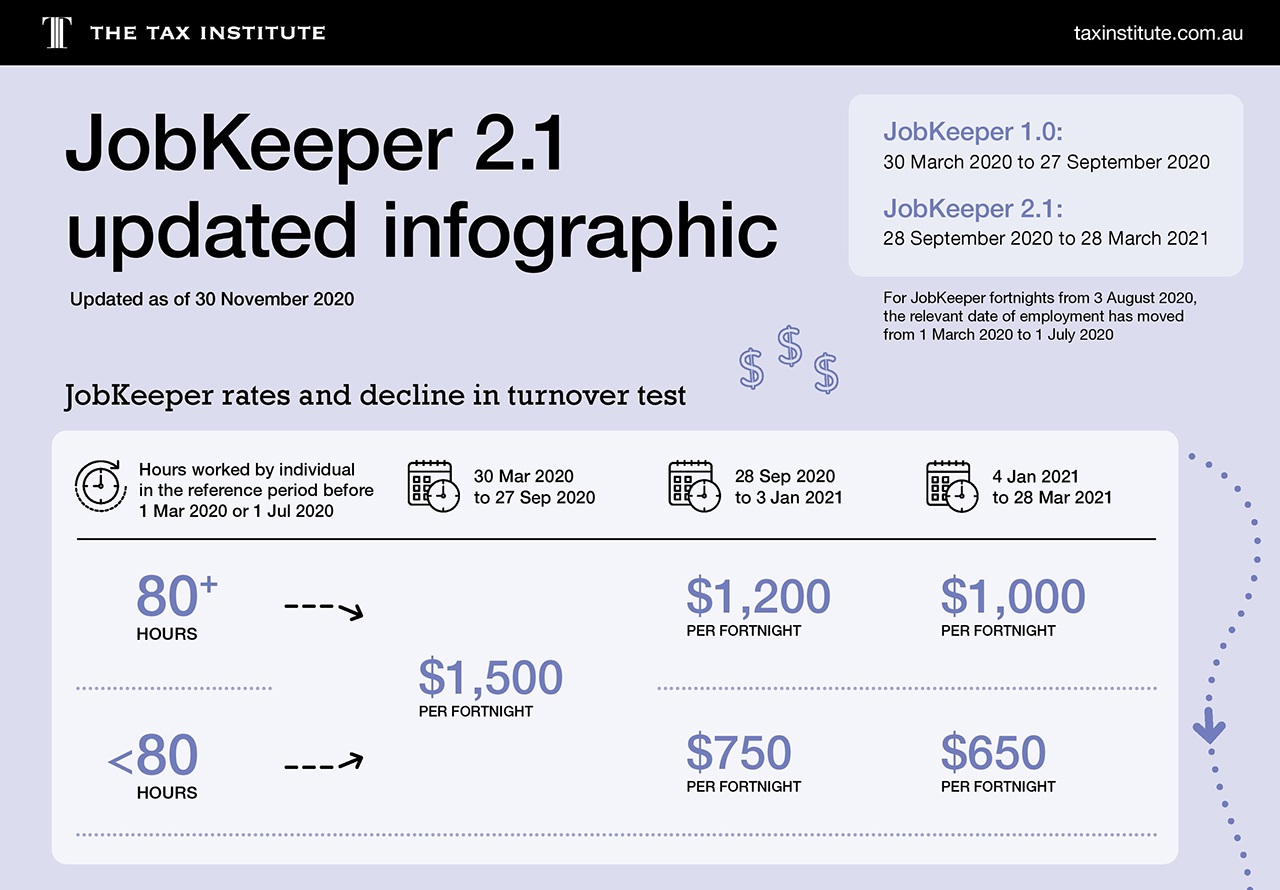

Under the JobKeeper 2.0 changes announced on 21 July 2020:

- A two-tiered system will apply so that employees who worked for 20 hours or more in the four-week period before 1 March 2020 will be entitled to a higher JobKeeper amount than those employees who worked less than 20 hours on average in February 2020.

- The fortnightly rate will be reduced from $1,500 in two stages:

- From 28 September 2020 to 3 January 2021, the full fortnightly rate will be $1,200 and the partial rate will be $750;

- From 4 January 2021 to 28 March 2021, the full fortnightly rate will be $1,000 and the partial rate will be $650.

- Unlike the current JobKeeper rules which require businesses to satisfy the decline in turnover test only once for a single month or quarter between March and September 2020, the new rules proposed to require businesses to continue to meet a modified decline in turnover test from September 2020 to March 2021. Under the new rules, to be eligible for JobKeeper:

- From 28 September 2020 to 3 January 2021, businesses will need to demonstrate that their actual GST turnover has declined by the requisite percentage in both the June and September 2020 quarters, relative to the corresponding quarters in 2019;

- From 4 January 2020 to 28 March 2021, businesses will need to demonstrate that their actual GST turnover has declined by the requisite percentage in each of the June, September and December 2020 quarters, relative to the corresponding quarters in 2019.

Further detail on these changes is available here and a useful infographic on JobKeeper 2.0 is available here.

It is proposed that businesses will be required to demonstrate that their actual GST turnover has declined by the requisite percentage in consecutive quarters. This does not have regard for those businesses whose situations may have improved slightly in the June 2020 quarter but have deteriorated in the September or December quarters, such as those in Victoria that are subject to the Stage 4 restrictions.

JobKeeper 2.1

Further change to decline in turnover test

Under the JobKeeper 2.1 changes announced on 7 August 2020, to be eligible for JobKeeper:

- From 28 September 2020 to 3 January 2021, businesses will need to demonstrate that their actual GST turnover has declined by the requisite percentage in the September 2020 quarter only, relative to the corresponding quarter in 2019;

- From 4 January 2020 to 28 March 2021, businesses will need to demonstrate that their actual GST turnover has declined by the requisite percentage in the December 2020 quarter only, relative to the corresponding quarter in 2019.

This is a sensible modification which will allow many Victorian businesses that did not suffer the requisite decline in their turnover in the June 2020 quarter but have since seen a significant deterioration in their revenue to now qualify for JobKeeper.

New employment date

A further change will see the relevant date of employment move from 1 March 2020 to 1 July 2020 which will allow more employees to be eligible for JobKeeper. While this is welcome, there are two considerations:

- The change will apply from 3 August 2020, i.e. JobKeeper fortnight 10. Given that amending legislation cannot be introduced into Parliament any earlier than 24 August, employers would need to satisfy the wage condition before they can determine if they are eligible to claim JobKeeper for these employees. Hopefully, additional time to meet the wage condition for fortnights 10 and 11 will be allowed.

- Section 9(3)(b)(iii) of the JobKeeper Rules prevents an individual from being an eligible employee if they have given any other entity, or the Commissioner, a JobKeeper nomination notice. While this is designed to prevent an employee claiming JobKeeper through two employers at the same time, as the law currently stands, an individual can only be an eligible employee of a current employer if they had not previously nominated with a former employer. Without a legislative amendment, individuals who are employed as at 1 July 2020 would be ineligible for JobKeeper if they had previously nominated with a former employer.

How to apply for JobKeeper as an employer

Step 1: Enrol

Enrol for JobKeeper payments by using your myGovID to login to the Business Portal. Once logged in, select ‘Manage employees’ and fill in the JobKeeper enrolment form. The required fields you’ll need to fill in include:

Nominate the expected fall in your turnover. This needs to be at least 30%, or at least 50% if your turnover is more than $1 billion. If you’re a charity, school or university, you’ll need to be expecting at least a 15% fall in turnover.

The month your turnover fell (or is expected to fall)

The number of employees expected to be eligible for JobKeeper payments. If you’re business is a partnership, trust or company do not include the eligible business participant. Eligible business participants for trusts, partnerships or companies are detailed in the next field.

Contact and bank details

Step 2: Identify eligible employees

Either the employer or a registered tax or BAS agent should identify each employee that is eligible and being nominated for the JobKeeper payment.

While you only need to do this step once, you’ll need to maintain the list of employees and their details on a monthly basis and advise employees of any changes.

The ATO has released detailed instructions on determining eligibility.

Step 3: Reconfirm monthly

Each month, you or your registered tax or BAS agent need to make a declaration reconfirming the eligibility of your business and the nominated eligible employees. You can do this through the Business Portal, where you need to:

- review your eligible employees each JobKeeper fortnight and update your list if there are any changes

- provide your current and projected GST turnover (this is not to retest eligibility, but to see how your business is fairing)

- re-confirm your contact and bank details for payment.

You can also read the ATO’s full guide to applying for JobKeeper scheme, for employers using STP and employers who don’t use STP.

How to apply for JobKeeper as a sole trader

The process of applying for JobKeeper payments as a sole trader is very similar to other employers. The main difference is that when you enrol, you will need to nominate that you are applying as a sole trader and confirm you meet the requirements. The process will differ depending on whether or not you have employees.

Read the ATO’s full guide for sole traders.

Applying for JobKeeper with Single Touch Payroll

If you use Single Touch Payroll, the process for applying for JobKeeper doesn’t change much, except when identifying your eligible employees. If you use STP software that has JobKeeper functionality, you can update eligible employees and lodge via your STP software.

You may then need to login to Business Portal to register the eligible business participant and provide a start period if needed. But then, future changes to your employees’ eligibility can be made through your STP software.

How to apply the turnover test

The turnover test allows you to establish your expected fall in turnover before applying for JobKeeper payments. The basic turnover test, which most businesses will use, has 5 steps:

- Identify the turnover test period. This can be a month or quarter, regardless of whether you report quarterly or monthly.

- Identify the comparison period. This is the period in 2019 that corresponds to the turnover test period.

- Work out the GST turnover. Determine what your projected GST turnover will be for the test period and what your GST turnover was in the comparison period.

- Calculate the shortfall percentage. The shortfall (difference between the test period and the comparison period) will need to be at least 30% in most cases.

Determine if your turnover makes you eligible for JobKeeper. Depending on your GST turnover shortfall and your aggregated turnover, you’ll be able to determine your eligibility.

Published: 10 June 2020