JobKeeper 2.1

Published:

Note: the information on this page refers to the 2020 COVID-19 stimulus measures. Please check dates carefully.

Looking for the latest on COVID-19 support measures? Explore our guide to 2021 COVID-19 Support Package.

On 21 July 2020, in light of the continuing COVID-19 crisis, the Government announced it will extend the JobKeeper program by six months to 28 March 2021. However, the worsening economic conditions in Victoria due to the Stage 4 restrictions have caused the Government to rethink the eligibility conditions and make some further changes.

On 7 August 2020, the details of JobKeeper 2.1 were announced. This article discusses the announced changes to JobKeeper and what the redesigned rules mean for employers and employees beyond September.

Quick links

JobKeeper 2.0

The Government announced on 21 July 2020 that a modified JobKeeper program will continue for another six months beyond its legislated end date of 27 September 2020 until 28 March 2021. This follows a three-month review of JobKeeper which concluded that the case for extending JobKeeper beyond September is strong.

No changes will be made to the existing JobKeeper arrangements until 28 September 2020.

Under the JobKeeper 2.0 changes announced on 21 July 2020:

- A two-tiered system will apply so that employees who worked for 20 hours or more in the four-week period before 1 March 2020 will be entitled to a higher JobKeeper amount than those employees who worked less than 20 hours on average in February 2020.

- The fortnightly rate will be reduced from $1,500 in two stages:

- From 28 September 2020 to 3 January 2021, the full fortnightly rate will be $1,200 and the partial rate will be $750;

- From 4 January 2021 to 28 March 2021, the full fortnightly rate will be $1,000 and the partial rate will be $650.

- Unlike the current JobKeeper rules which require businesses to satisfy the decline in turnover test only once for a single month or quarter between March and September 2020, the new rules proposed to require businesses to continue to meet a modified decline in turnover test from September 2020 to March 2021. Under the new rules, to be eligible for JobKeeper:

- From 28 September 2020 to 3 January 2021, businesses will need to demonstrate that their actual GST turnover has declined by the requisite percentage in both the June and September 2020 quarters, relative to the corresponding quarters in 2019;

- From 4 January 2020 to 28 March 2021, businesses will need to demonstrate that their actual GST turnover has declined by the requisite percentage in each of the June, September and December 2020 quarters, relative to the corresponding quarters in 2019.

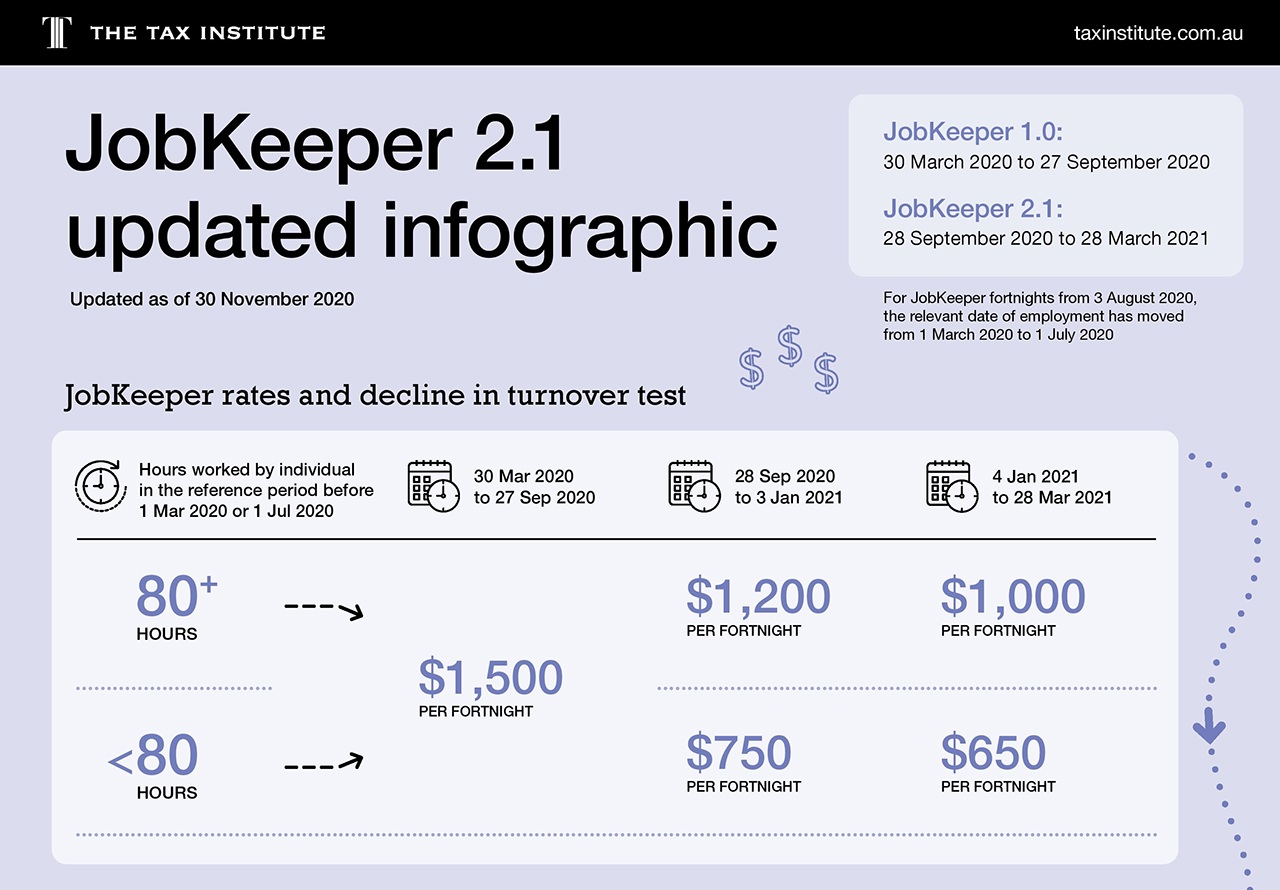

Further detail on these changes is available here and a useful infographic on JobKeeper 2.0 is available here.

It is proposed that businesses will be required to demonstrate that their actual GST turnover has declined by the requisite percentage in consecutive quarters. This does not have regard for those businesses whose situations may have improved slightly in the June 2020 quarter but have deteriorated in the September or December quarters, such as those in Victoria that are subject to the Stage 4 restrictions.

JobKeeper 2.1

Further change to decline in turnover test

Under the JobKeeper 2.1 changes announced on 7 August 2020, to be eligible for JobKeeper:

- From 28 September 2020 to 3 January 2021, businesses will need to demonstrate that their actual GST turnover has declined by the requisite percentage in the September 2020 quarter only, relative to the corresponding quarter in 2019;

- From 4 January 2020 to 28 March 2021, businesses will need to demonstrate that their actual GST turnover has declined by the requisite percentage in the December 2020 quarter only, relative to the corresponding quarter in 2019.

This is a sensible modification which will allow many Victorian businesses that did not suffer the requisite decline in their turnover in the June 2020 quarter but have since seen a significant deterioration in their revenue to now qualify for JobKeeper.

New employment date

A further change will see the relevant date of employment move from 1 March 2020 to 1 July 2020 which will allow more employees to be eligible for JobKeeper. While this is welcome, there are two considerations:

- The change will apply from 3 August 2020, i.e. JobKeeper fortnight 10. Given that amending legislation cannot be introduced into Parliament any earlier than 24 August, employers would need to satisfy the wage condition before they can determine if they are eligible to claim JobKeeper for these employees. Hopefully, additional time to meet the wage condition for fortnights 10 and 11 will be allowed.

- Section 9(3)(b)(iii) of the JobKeeper Rules prevents an individual from being an eligible employee if they have given any other entity, or the Commissioner, a JobKeeper nomination notice. While this is designed to prevent an employee claiming JobKeeper through two employers at the same time, as the law currently stands, an individual can only be an eligible employee of a current employer if they had not previously nominated with a former employer. Without a legislative amendment, individuals who are employed as at 1 July 2020 would be ineligible for JobKeeper if they had previously nominated with a former employer.

What happens next?

The announcements by the Government on 21 July 2020 and 7 August 2020 need to be reflected in legislative amendments. The current JobKeeper legislation prevents payments being made by the Government beyond 31 December 2020 so an amending bill requiring a sitting of Parliament will be necessary, and is likely to be complemented by a legislative instrument issued by the Treasurer which will set out the details of the new rules. Further details will be available once the legislative amendments are released and updated ATO guidance is published.

The Government estimates that the total cost of the JobKeeper Payment until March 2021 will now be over $100 billion. JobKeeper 2.1 represents a further increase in the cost of the program by $15.6 billion.

JobKeeper 2.1: Fair Work Act changes

Note: This article does not intend or purport to provide guidance on the detailed operation of the provisions of the Fair Work Act 2009. Its purpose is to increase awareness of the impact proposed legislative amendments will have on the accounting profession insofar as the changes relate to the JobKeeper decline in turnover test. First published and correct as of 27 August 2020.

In response to the continuing economic effects from the COVID-19 pandemic, the Government announced on 21 July 2020 that the JobKeeper program will be extended to 28 March 2021. Further changes were announced on 7 August 2020.

The combined effect of the extension to JobKeeper and the recent economic deterioration in Victoria bring the total estimate of the cost of the JobKeeper program to $101.3 billion.

The JobKeeper 2.1 changes are explained in this article and are summarised in this handy infographic.

Under the current JobKeeper legislation, the Government is unable to make JobKeeper payments beyond 31 December 2020 (the Treasurer’s legislative instrument set an original end date for the JobKeeper program of 27 September 2020).

Amending legislation

The Coronavirus Economic Response Package (Jobkeeper Payments) Amendment Bill 2020 (‘the Bill’) was introduced into Parliament on 26 August 2020. The Bill proposes to extend the JobKeeper program and allow the Government to make JobKeeper payments until 28 March 2021.

Detailed rules setting out the new reduced two-tiered rates and the modified decline in turnover test will supplement the amending legislation. These will be contained in a separate legislative instrument to be issued by the Treasurer.

Further details will be available once the legislative instrument is released and updated ATO guidance is published.

The Bill was before the House of Representatives at the time of writing this article.

Changes to the Fair Work Act

In separate legislation enacted on 9 April 2020, the Coronavirus Economic Response Package Omnibus (Measures No. 2) Act 2020 contained amendments which inserted Part 6-4C into the Fair Work Act 2009 (FWA). These measures temporarily allow employers to vary the working arrangements (by way of JobKeeper enabling directions or agreements under Part 6-4C) of employees for whom the employer is receiving JobKeeper payments. In the absence of these amendments, the more rigid terms and conditions under awards and enterprise agreements would apply.

The measures in Part 6-4C are time limited and were originally set to be repealed on 28 September 2020, the day after the JobKeeper program was originally due to end. To support the extension to JobKeeper, the Bill proposes to extend the temporary measures in Part 6-4C — albeit in a modified way — until 29 March 2021, the day after the extended JobKeeper program is now due to end.

Access to the temporary measures in Part 6-4C will depend on whether the employer is a qualifying employer or a legacy employer.

Qualifying employers

Employers who continue to be eligible for JobKeeper after 28 September 2020 are termed ‘qualifying employers’. These employers will retain access to the full range of flexibility measures in Part 6-4C until 29 March 2021, with the exception of the annual leave provisions which are being repealed on 28 September 2020.

The annual leave provisions enables employers and employees to make agreements for increased flexibility around annual leave arrangements. More particularly, the provisions govern how an employee (whose employer qualifies for the JobKeeper payment scheme in relation to them) considers their employer’s request to take paid annual leave and to agree (despite any designated employment provision) to take annual leave at half pay.

Legacy employers

Employers who have received one or more JobKeeper payments between 30 March 2020 and 27 September 2020, who no longer qualify for JobKeeper after 27 September 2020, are termed ‘legacy employers’.

A legacy employer who has a certificate stating that they have suffered at least 10% decline in turnover (DIT) will have access to modified flexibility measures in Part 6-4C from 28 September 2020 until 29 March 2021.

For a JobKeeper direction given:

- before 28 October 2020 — the employer must satisfy the 10% DIT test for the June 2020 quarter;

- between 28 October 2020 and 27 February 2021 — the employer must satisfy the 10% DIT test for the September 2020 quarter;

- on or after 28 February 2021 — the employer must satisfy the 10% DIT test for the December 2020 quarter.

These dates align with the quarterly BAS lodgment dates rather than the JobKeeper DIT test rules because legacy employers are no longer participating in JobKeeper so those dates are not relevant to them. The use of the BAS lodgment dates is designed to minimise the regulatory burden on businesses that are still in financial distress.

To illustrate the operation of this, if a legacy employer sought to access the temporary FWA measures in November 2020, they would have had to suffer at least a 10% decline in their GST turnover in the September 2020 quarter compared to the September 2019 quarter.

There will be two groups of legacy employers:

- the first group will be those employers exiting JobKeeper on 28 September 2020 because they no longer meet the new DIT test for the September quarter under JobKeeper 2.1; and

- the second group will be those employers exiting JobKeeper on 4 January 2021 because they no longer meet the new DIT test for the December quarter under JobKeeper 2.1.

Issues with calculating the decline in turnover

Proposed new s 789GCB of the FWA sets out the requirements of the 10% DIT test.

In determining whether a legacy employer satisfies the DIT test for FWA purposes:

- the turnover test period is assumed to be the June, September or December 2020 quarter instead of the period determined under the JobKeeper rules;

- current GST turnover is used rather than projected GST turnover — this will result in the proceeds from sales of capital assets being included in the turnover calculation;

- the specified percentage is 10% rather than the 30% or 50% percentages which apply for JobKeeper purposes;

- the JobKeeper alternative DIT tests can be used in calculating the decline;

- it is unclear whether the alternative methods of calculating GST turnover set out in LCR 2020/1 will continue to be available under JobKeeper 2.1 and for the purposes of applying the 10% DIT test.

It is possible that there could be two sets of rules to calculate GST turnover: one for JobKeeper for qualifying employers and one for the FWA for legacy employers. This would likely cause confusion for employers and accountants and lead to inadvertent errors.

The certificate

A legacy employer will have access to modified flexibility measures in Part 6-4C after exiting JobKeeper until 29 March 2021, provided they have a certificate stating that they have suffered at least a 10% DIT in the designated quarters.

The certificate must be issued by an eligible financial service provider, defined to mean:

- a registered company auditor or qualified accountant under the Corporations Act 2001;

- a registered tax agent, BAS agent or tax (financial adviser) under the Tax Agent Services Act 2001.

The meaning of an eligible financial service provider does not include a lawyer.

The written certificate must relate to a specified employer and state that:

In the opinion of the eligible financial service provider, the employer satisfied the 10% decline in turnover test for the designated quarter applicable to a specified time.

A certificate cannot be issued by an eligible financial service provider if they are:

(a) a director or employee of the employer;

(b) an associated entity1 of the employer; or

(c) a director or employee of an associated entity1 of the employer.

This ensures that the certificate can only be issued by someone who is independent of and external to the employer.

There is no prescribed form for the certificate.

Exception for small business employers

There is an exception for small business employers (fewer than 15 employees2) who are not required to obtain a 10% DIT certificate from an eligible financial service provider.

As an alternative, small business employers may choose to make a statutory declaration to the effect that the employer satisfies the 10% DIT test for the designated quarter applicable to a specified time. If a small business employer makes such a statutory declaration, it is taken to be a 10% DIT certificate.

Small business employers may choose to obtain a certificate from an eligible financial service provider rather than making a statutory declaration.

A small business employer who chooses to make a statutory declaration should use the Commonwealth statutory declaration form (available from the Attorney-General’s Department website).

Impact of these changes on the accounting profession

Employers exiting from JobKeeper will need to undertake extensive calculations to determine whether they qualify as a legacy employer. The requirement for legacy employers to obtain a certificate from an eligible financial service provider (unless they are a small employer and choose to make a statutory declaration) will place a significant burden on accounting practitioners.

They will need to undertake this work in addition to the significant work arising from the changes under JobKeeper 2.1, on top of their usual workloads. Accountants have been working, and continue to work, extremely hard to assist their clients to determine whether they are eligible for JobKeeper, and assisting with their clients’ enrolment and reporting obligations if they are eligible. These proposed changes will necessitate them now also having to undertake similar calculations for their clients who exit JobKeeper to determine whether they qualify as a legacy employer.

Who will pay for this work to be undertaken? It is unlikely that employers exiting JobKeeper will see the value in paying their accountants to undertake this work.

Further, there is a risk that this work won’t be done (because accountants may not have the capacity to do the work or employers refuse to pay for it). Accordingly, while some employers may be eligible to be legacy employers, they may decide not to take advantage of this concession. There is also a risk of self-assessment where employers decide to undertake the calculations themselves instead of seeking advice from an accountant. This may lead to erroneous data unwittingly being relied upon by accountants to issue certificates, and a risk of mis-steps by small business employers.

Determining whether an employer satisfies the DIT test involves complex and detailed calculations which require a thorough understanding of the operation of provisions in the GST Act (and currently, under JobKeeper 1.0, associated ATO guidance such as LCR 2020/1). While registered tax agents are familiar with these provisions and guidance, and are authorised to give advice on these matters, registered company auditors, BAS agents and tax (financial) advisers may be less familiar with the relevant provisions in the tax law and associated ATO guidance. Would this latter group of practitioners be operating within the Tax Agent Services Act 2009?

Finally, given the 10% DIT certificate is issued under proposed new s 789GCD of the FWA, accountants will be required to operate under the FWA. This is an area of legislation that most accountants would be unfamiliar with and not qualified to provide advice on.

This raises the following questions:

- What is the risk for accountants who will be required to operate under the FWA?

- What defences are available to them where they get it wrong notwithstanding that they have applied reasonable care and diligence?

- To what extent will accountants be exposed to liability where they have, in good faith, relied upon information provided by their client?

Update on 1 September 2020

On 1 September 2020, the Government amended the Bill in the Senate to make the following changes:

- Remove ‘registered company auditor’ and ‘tax (financial) adviser’ from the list of eligible financial service providers. This means that only registered tax agents, registered BAS agents and qualified accountants will be able to issue the 10% DIT certificates.

- Replace the requirement that the certificate state “in the opinion of the eligible financial service provider …” with “confirms that”. This makes it clear that the issuing of the certificate involves a declaration from an eligible financial service provider that relates to a specific employer and confirms that the employer satisfied the 10% DIT test for the designated quarter applicable to a specified time. This requires the eligible financial service provider to confirm that the test has been met based on the information provided, and does not constitute an audit or assurance engagement.

These changes were agreed to by the House of Representatives on 1 September, so the Bill has been passed by the Parliament. The Bill now awaits Royal Assent.

1 ‘Associated entity’ has the meaning given by s 50AAA of the Corporations Act 2001.